Nothing turns people against each other faster than mishandled money. I have seen it affect churches, families, and friends. People who you thought would go through anything with someone else abruptly end the relationship because of this one thing!

Luke 12:42- And the Lord said, Who then is that faithful and wise steward, whom his lord shall make ruler over his household, to give them their portion of meat in due season?

A faithful and wise steward is someone who handles accounts well. They are in charge of paying bills, grocery shopping, feeding the family, scheduling, and all the other little things that are required to make the household or business operate smoothly.

Titus 1:7- For a bishop must be blameless, as the steward of God; not selfwilled, not soon angry, not given to wine, no striker, not given to filthy lucre;

Many churches are hung up on "the pastor of one wife" (I Timothy 3) meaning that a person can't be a pastor if they've been divorced. However, they look over the other listed qualifications as though they aren't really that important. If a person isn't apt to teach, they shouldn't be holding the office of a pastor. If they can't control the children living in their house, then they shouldn't be in charge of a congregation. And if they are given to filthy lucre (greedy for material goods) they should step down from a position of authority.

Does this mean that only a pastor should have to be a good steward? Not at all! All of God's disciples should be a good steward with what He has put under their hand. This could be a church, or a household, or a business, or a ministry, etc.

I Corinthians 4:1- Let a man so account of us, as of the ministers of Christ, and stewards of the mysteries of God.

We will all stand before God and give an account of how we used the things He gave us while we were on this earth. If we want to be considered a wise steward then we will learn how to manage what He has provided.

The word "manage" is the key. You'll almost never find an accountant without a bookkeeping software. They use these spreadsheets and programs to keep track of incoming monies and outgoing debts. And, we can learn a lot from how they utilize these programs.

The first step in management is to have everything in order. If you are building a house then you need a checklist of steps that you can tick off when you've accomplished them. You're not going to get a house built without a permit. You won't get a permit without proper paperwork being submitted to the correct oversight committee. And, before you can submit the proper paperwork you need surveys and plans. Everything done in the proper order.

I Corinthians 14:40- Let all things be done decently and in order.

So, how do we begin? By writing it down. You can purchase a planner or even a notebook for this- I personally like Homemaker's Friend.

If you are scheduling things, make sure you have a calendar where you can write the appointment, address, and time while also making note of who the appointment is for, who needs to be there, and any special paperwork or documents that you may need to bring.

This is by far the easiest way to keep things scheduled and on-track without over planning or double booking. What types of things would you need a planner for? Well, vacations, home improvement work, play dates, doctor appointments, and anything where you need to make certain you are where you need to be on time.

If you are the one who makes the meals and does the shopping, then you should take the time to create a menu (I have about 5 weeks of menus that I've created where I can choose meals from so we get a good variety). After you have your menu, then you create your shopping list.

Go through your recipes and cabinets and write down anything that you need to buy that you don't have on hand. Don't forget breakfast and lunch items! If you are on a strict budget, then you're going to want to enter all the items in the cart on the Walmart shopping app to get an idea of how much your groceries will cost you. You can then adjust your menu or go for some store-brand items to save money. Only buy what is on your list!

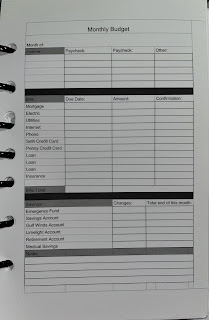

If you are in charge of finances, then you will have a few more steps.

The first step is to list out all of your debts with the approximate monthly amounts in the order that they are due. Then, you will decide which paycheck those bills will get paid from.

Example:

Hubby's Check #1 ($1,300)

- Tithe

- Groceries

- Phones

- Internet

- Electric

Wife's Check #1 ($500)

- Credit Cards

- Tithe

Hubby's Check #2 ($1,300)

- Mortgage

- Groceries

Wife's Check #2 ($500)

- Utilities

- Insurance